KUALA LUMPUR, Malaysia — Malaysia Airlines’ two crashes in less than five months are sending tremors through the aviation insurance market — not least because the carrier’s $2.25 billion overall liability policy is mysteriously missing a standard phrase that usually limits insurers’ payments for search-and-rescue costs.

The looming payments are coming as underwriters face other claims, because of the shelling of Libya’s main airport a week ago, with 20 planes damaged, and a pair of deadly Taliban attacks on Karachi’s airport in Pakistan.

For just one category of aviation insurance — war risk insurance on the planes — estimated claims for incidents in the last five months now total up to $600 million for a sector that collects $65 million a year in premiums.

Airlines have many insurance policies. But the main one is an “all risk” policy that covers most crash-related expenses, including what is usually the biggest: paying for settlements with passengers’ next of kin.

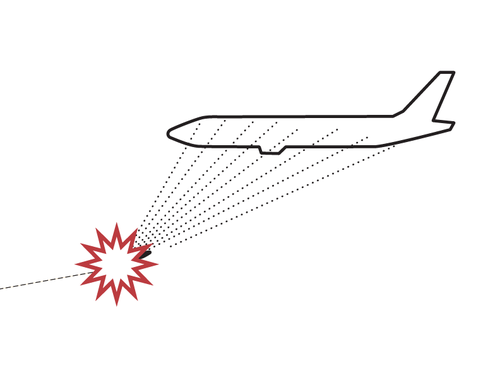

Graphic

Wreckage Offers Clues on Why Flight 17 Went Down

Photographs of a piece of wreckage from Malaysia Airlines Flight 17 offer evidence about what could have caused it to crash.

Malaysia Airlines’ broader policy has a high cap by industry standards — $2.25 billion for each crash — because the carrier operates big Airbus A380s, each configured for 494 passengers, and it wanted ample coverage.

But the policy is unusual in that it does not have a separate sublimit for search-and-rescue costs — it is limited only by the overall $2.25 billion cap for the policy, three people with knowledge of the policy said. It is unclear why the clause was omitted, they said.

The absence of a sublimit for search-and-rescue costs means that Malaysia Airlines could seek reimbursement for tens of millions — and potentially hundreds of millions — of dollars in search costs if the Malaysian and Australian governments decide to bill the airline for even part of their considerable expenses in looking for Flight 370, which vanished on March 8.

An Australian delegation has been sent to Malaysia to broach the question of sharing costs for the Flight 370 investigation and seeking insurance reimbursement, said people with knowledge of the visit and the insurance policy, who spoke on the condition of anonymity.

By tradition, governments do not seek reimbursement from an airline for search-and-rescue costs. As a result, the airlines do not typically need to ask their insurers to cover these costs; the insurers cover only so-called commercial costs, though their contracts do allow governments to seek reimbursement.

In the case of Flight 370, the Australian government is paying 8 million Australian dollars, or $7.5 million, to commercial contractors for a survey of the floor of the Indian Ocean, and has set aside another 60 million Australian dollars to hire a contractor to tow deep-sea submersibles across 60,000 square kilometers of the ocean floor to look for the missing plane.

Australian officials, Malaysian officials and the lead underwriter of the broad liability policy, Allianz of Germany, all declined to comment, as did the broker who negotiated the insurance policy on Malaysia Airlines’ behalf, the London-based Willis Group Holdings.

The crash of Flight 17 appears to have caught the war risk insurance market particularly by surprise. Insurers often prohibit airlines from flying across dangerous areas, or cancel their policies, but most carriers kept flying over Ukraine until the crash. The number of flights there dropped only 12 percent in the month leading up to it.

“One assumes that if the war risk underwriters thought there was any risk, they would have prohibited airlines from flying or canceled their policies,” said Paul Hayes, head of accidents and insurance at Ascend, an aviation consulting firm in London.

Malaysia Airlines’ war risk policy has a separate, much lower limit than the overall policy for claims for search-and-rescue costs. As in most aviation insurance contracts, a provision caps claims for these costs to a small percentage of the overall value of the policy.

Graphic

Maps of the Crash of Malaysia Airlines Flight 17

A Malaysia Airlines flight with nearly 300 people aboard crashed in eastern Ukraine near the Russian border on Thursday.

The Atrium Underwriting Group, the lead underwriter for Malaysia Airlines’ war risk insurance, said in a statement that it had immediately approved payment for the loss of the aircraft in Flight 17. Aon, a London-based company that is one of the world’s largest insurance brokers, said over the weekend that the plane had been insured for $97.3 million, but Atrium did not confirm the value.

The crash of Flight 370 triggered a half-payment from Atrium under the war risk policy after adjusters concluded that there was a substantial but not ironclad case that the crash may have involved pilot suicide or other criminal action. War risk policies also cover deliberate, malicious acts.

The Allianz-led policy — Allianz itself has only 9 percent of the exposure, having shared the rest with other underwriters — paid the balance of the cost of that aircraft, which had been insured for $100.2 million, insurance executives said.

Insurance adjusters agreed with the Malaysian government there was a strong but not fully proved possibility that Flight 370 was lost because of deliberate action, given that the plane made a series of at least four well-executed turns over the course of an hour before heading south across the Indian Ocean until it apparently ran out of fuel. The final compromise followed a precedent in other cases in which pilot suicide was suspected but not proved.

“It was basically split between the two policies,” said Neil Smith, the head of underwriting at the Lloyd’s Market Association, a trade group composed of Lloyd’s of London insurance underwriters.

The crashes of Flight 370 and Flight 17 are not Malaysia Airlines’ first unusual insurance claims, however. The airline had an unusual claim in 2000 for the total loss of an Airbus A330 traveling in the opposite direction on the same route as Flight 370.

In that case, a canister of a mysterious Chinese shipment destined for Iran broke open near the end of a trip from Beijing to Kuala Lumpur and began leaking, producing a smell that prompted the captain to conduct an emergency evacuation upon landing of all 266 people aboard. A subsequent investigation found that the hold was contaminated beyond cleaning with mercury and other chemicals that may have been precursors for the manufacture of nerve gas.

The Malaysian government ended up digging a large hole in the ground near the airport tarmac and burying the entire plane. Insurers paid a full settlement of $90 million.

Airline insurance premiums are set through an annual process in which underwriters bid for which provider will offer the lowest premiums at the best terms. Few airlines’ policies have been renewed yet; Malaysia Airlines’ has not. Until this year, Malaysia Airlines paid some of the lowest insurance premiums in the global aviation market, because it had a fairly young fleet of Boeing and Airbus planes.

“With a shallow premium pool fully exhausted and an expectation of an immediate review of the current hull war premium rating, MH17 and incidents recently in Pakistan and Tripoli look likely to be the events that may halt the decline in aviation premium income and usher in the reintroduction of increases once again,” said Gary Moran, the head of Asia aviation brokerage for Aon.

Many leases and other contracts in the airline industry require carriers to be insured. Despite recent losses, Mr. Smith said, airlines were still able to obtain insurance, though he declined to speculate on the likelihood of increases in premiums.

“If it wasn’t available,” he said, “the airlines wouldn’t be able to fly.”